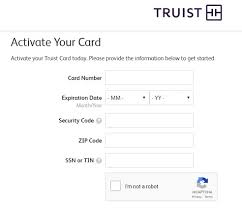

truist app

There's a new software in town and it goes by the name of Truist. What maksera this application so special? Unlike other money-managing apps, Truist doesn't just concentrate on budgeting. In addition, it allows you to track your investments and bank accounts all in one place. This is a huge time-saver for anyone who's juggling multiple accounts and wants to remain in addition to their finances. The application is user friendly and has a huge amount of great features, like goal setting and keep track ofing, performance analysis, and even bill pay. You can even hook up with your financial advisor right from the application if you have any questions or need help getting started. If you're looking for an all-in-one money management solution, Truist is unquestionably worth looking into.